Case Study

Algorithmic Trading

Achieve higher profits with Artificial Intelligence.

For an English commodities market maker, a deep trading strategy has been developed based on deep learning models that recognize patterns in data while taking trading risks into account.

Development of a more profitable trading strategy with Artificial Intelligence.

Today, Artificial Intelligence is everywhere -and it is has arrived in the trading world. Rather than being the product of humans, profitable trading strategies are formed by computers. The machine – based on a framework defined by its creators - observes and learns the way the market works independently and forms what it considers to be the best strategy to attain the highest profit. A professional UK-based commodity market maker has challenged us to outperform the earnings of his trading strategy with our deep, neural-network-based AI trading, taking controlled risk management into account.

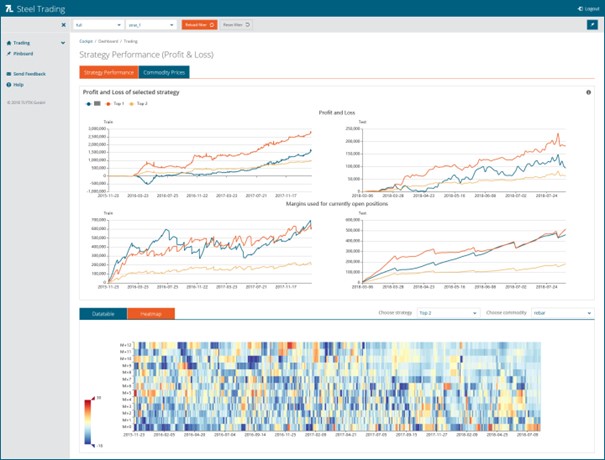

Task: The daily strategy in trading options of commodities should be improved. For this purpose, a Web application was developed, which issues daily trading recommendations and evaluates the fund's performance.

Available Data: 7LYTIX had approx. 2.5 years of price data for two related goods and options (scrap and rebar) available. The option period extends from 1 to 12 months.

Our approach: Neural networks were trained on yield maximization using deep learning techniques by establishing correlations between two related parameters (steel options on scrap and rebar), while taking controlled risk control into account. Therefore, the first 2 years of the dataset were used to evaluate the performance the last 5 months.

The result: Yield was increased by 13% over the test period of 5 months, assuming the same capital employed. The volatility of the strategy is a dynamic parameter that can be adjusted to the risk aversion of the client. This flexibility allows significantly higher yields - with only a slight change in the capital use.

Outlook: 7LYTIX is interested in partners from the finance community to develop together the broader use of Artificial Intelligence for fund management and trading. We see great opportunities beyond the use of time series in raw material options trading through the automated inclusion of globally available qualitative and quantitative information into the trading strategy.

7LYTIX developed a deep trading strategy - based on deep learning models - that are able to recognize patterns in data while taking the risk of trading actions into account. All process steps were developed by 7LYTIX. From the mathematical formulation of the problem to performance optimization and the user interface.

with only 15% more capital.

than the previously practiced market maker strategy.